Let's Get You Started

Let's Get You Started

Banking apps have become an indispensable tool for managing our finances on the go. But have you ever wondered about the behind-the-scenes costs that go into creating these sleek, user-friendly interfaces? Whether you’re a budding entrepreneur in the fintech sector, a business looking to expand into mobile banking, or just a tech enthusiast curious about app development, this post is your go-to resource. Let’s discuss the cost of developing a banking app in detail, exploring the intricacies of its costs, factors influencing them, and much more – all served with a pinch of creativity and a dash of professionalism.

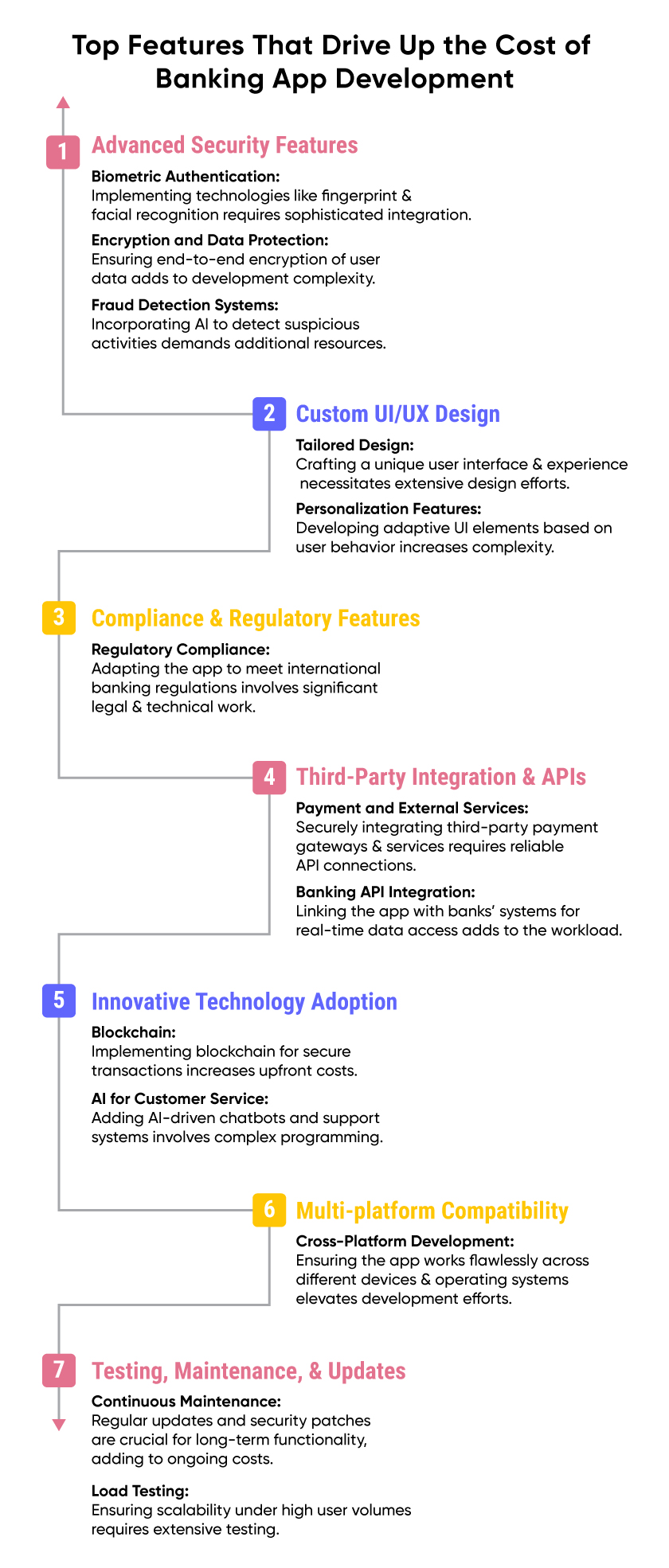

Developing a banking app isn’t just about coding; it’s about creating a secure, intuitive, and feature-rich platform that meets the needs of today’s savvy users. Here are the key components that add up to the cost:

Now, let’s talk numbers. The cost of developing a banking app can range widely, from $50,000 to over $500,000, depending on various factors. However, to give you a clearer picture, let’s break down the costs associated with different stages of app development:

| Development Stage | Estimated Cost Range |

| Conceptualization | $5,000 – $20,000 |

| Design | $10,000 – $50,000 |

| Development | $30,000 – $300,000 |

| Testing & Deployment | $10,000 – $50,000 |

| Compliance & Security | $5,000 – $25,000 |

| Marketing & Launch | $10,000 – $100,000 |

| Maintenance (Yearly) | $10,000 – $50,000 |

Note: These figures are rough estimates and can vary based on your specific requirements.

Embarking on the journey of creating a banking app is an exhilarating venture, teeming with possibilities yet fraught with challenges. At the heart of this endeavor lies a critical decision that could very well define the trajectory of your project: selecting the right development partner. This decision is pivotal, as the expertise, reliability, and innovation brought by your development team are crucial to translating your vision into a functional, secure, and user-friendly app. Here’s how to navigate this crucial step, ensuring your project is in capable hands.

Banking apps are not just any mobile applications; they require a nuanced understanding of financial technology (fintech), regulatory compliance, and security protocols. Look for a development partner with a proven track record in fintech. Review their portfolio for similar projects and don’t hesitate to ask for case studies or references. This due diligence will give you insights into their capability to handle complex financial applications and navigate the regulatory landscape that is intrinsic to banking and financial services.

Security is the linchpin of any banking app. A breach can have dire repercussions, not just financially but also in terms of customer trust and brand reputation. Your development partner should have a robust approach to security, incorporating best practices in data encryption, fraud prevention, and network security. Additionally, they should be well-versed in compliance standards relevant to your target market, such as GDPR in Europe, PCI DSS for payment cards, and any local banking regulations. Their ability to weave security and compliance into the fabric of your app is non-negotiable.

The technological backbone of your app will determine its performance, scalability, and the overall user experience. Discuss the tech stack your potential partner plans to use, ensuring it aligns with your project’s needs and future growth. The right partner should not only be proficient in current technologies but also forward-thinking, considering how emerging technologies could be leveraged to enhance your app. Whether it’s using cloud services for scalability, AI for personalized banking experiences, or blockchain for enhanced security, their technical acumen can set your app apart.

The methodology adopted by your development team impacts the project’s timeline, budget, and quality. Whether it’s Agile, Waterfall, or a hybrid approach, ensure their methodology promotes transparency, flexibility, and iterative testing. This alignment is crucial for managing expectations, making timely adjustments, and ensuring the project stays on track. A partner who involves you in the development process and keeps you informed at every stage is invaluable.

Effective communication is fundamental to the achievement of any project’s objectives. Your development partner should be able to clearly articulate ideas, provide constructive feedback, and be responsive to your queries. Cultural fit is equally important; they should share your work ethics, enthusiasm, and vision for the project. Remember, this is a collaborative journey, and a harmonious relationship with your development team will facilitate a smoother process and a more enjoyable experience overall.

While cost should not be the only determining factor, it’s important to ensure the pricing model proposed by your development partner aligns with your budget and project scope. Be wary of bids that seem too good to be true, as they may not cover all aspects of your project or may compromise on quality. A transparent pricing model, with clarity on deliverables, timelines, and provisions for unforeseen changes, will help in avoiding future disputes. Additionally, the contract should protect your interests, including intellectual property rights and confidentiality clauses.

Choosing the right development partner for your banking app is a multifaceted decision that extends beyond mere technical capabilities. It’s about finding a team that shares your vision, understands the fintech landscape, and is committed to creating an app that meets your strategic goals. Take your time, conduct thorough research, and engage in detailed discussions before making this pivotal decision. The right partnership will not only bring your vision to life but will also be a catalyst for innovation, growth, and success in the digital banking arena.

Can I develop a banking app on a tight budget?

Yes, starting with an MVP and focusing on core features can significantly reduce initial costs.

What’s the development time frame of a banking app?

The development timeline can range from 3 to 12 months, depending on the app’s complexity and the team’s size.

Are there any hidden costs in banking app development?

Beyond the obvious development costs, consider budgeting for app store fees, legal consultations, and unexpected compliance requirements.

How can I ensure my banking app is secure?

Investing in robust encryption, regular security audits, and compliance with financial regulations is crucial for protecting user data.

What’s the ROI of developing a banking app?

While the initial investment is significant, a well-executed banking app can enhance customer loyalty, reduce operational costs, and open new revenue channels.

Developing a banking app is a significant investment, both in terms of time and money. However, by understanding the factors that influence development costs and making informed decisions, you can create a banking app that not only meets your business objectives but also provides real value to your users. Remember, in the world of fintech, quality and security should never be compromised for cost. With the right app development company, your banking app can become the go-to financial companion for your users, offering them convenience, security, and innovative financial solutions at their fingertips.

Navigating the cost of developing a banking app requires a deep dive into your project’s specifics, market research, and a strategic approach to development. By leveraging this guide, you’re now equipped with the knowledge to embark on this exciting journey. Whether you’re aiming to revolutionize the banking experience or simply enhance your existing services, the investment in a banking app has the potential to pay dividends in customer satisfaction and business growth. Let’s innovate, but wisely – your future banking app awaits!

Welcome to Appxide, where innovation meets utility in the world of app development. Our mission is to craft cutting-edge digital solutions that simplify lives and spark connections. With a diverse portfolio that traverses multiple sectors, we are committed to excellence and user-centric design. Stay tuned to our blog for the latest in tech, insights, and the stories behind our projects. Dive into the future with us – where every app we create is a step towards the extraordinary.