Let's Get You Started

Let's Get You Started

Starting an app startup can be exciting, but one of the most challenging parts is figuring out how to get seed funding for an idea. Seed funding is essential for turning your innovative concept into a functional product and gaining traction in the market. With this Appxide guide, you’ll explore the best ways to secure startup funding, share practical seed funding tips for entrepreneurs, and discuss the steps to attract angel investors for a startup.

Before exploring methods for securing seed funding, it’s essential to understand what seed funding is. Seed funding is the initial capital used to start developing a business idea. This funding helps cover early costs such as product development, market research, and initial marketing efforts. The “seed” will hopefully grow into a successful business.

One of the first steps to attract angel investors for a startup is to have a well-thought-out business plan. Your business plan should clearly convey your vision, mission, market opportunity, competitive marketplace, revenue model, and financial projections. Here are some key components:

An MVP is a basic version of your app that includes only the core features necessary to solve the main problem for your target users. Creating an MVP allows you to test your idea with real users at a lower cost and gather valuable feedback. This step is crucial in early-stage investment strategies as it demonstrates the feasibility and potential of your idea to investors.

Networking is a critical element in raising capital for new business ideas. Attend industry events, join startup incubators and accelerators, and participate in pitch competitions. Building relationships with other entrepreneurs, mentors, and potential investors can open doors to funding opportunities.

You can explore several methods to get seed funding for your app startup. Below are a few of the most effective methods for obtaining startup financing:

Bootstrapping involves using your savings to fund your startup. This method gives you complete control over your business but can be financially risky. It’s often used in combination with other funding methods.

Raising funds from friends and family is a common initial step. They may be more willing to invest based on their trust in you rather than the business idea itself. However, mixing personal relationships with business can be tricky, so setting clear terms and expectations is essential.

Angel investors offer initial funding in return for ownership equity or convertible debt. In addition to financial support, they also provide valuable mentorship and industry connections. To attract angel investors:

Venture capitalists are experienced teams that handle combined funds from numerous investors. They allocate these funds to early-stage companies with significant potential for growth. However, VCs typically look for more established startups than angel investors. To attract VCs:

Crowdsourcing websites such as GoFundMe, Kickstarter , and Indiegogo enable you to collect small sums of money from numerous individuals. Crowdfunding can also validate your idea and build an initial user base. Successful crowdfunding campaigns usually have the following:

Numerous grants and startup competitions offer funding. While highly competitive, these can provide non-dilutive capital (money that doesn’t require giving up equity). Research and apply to as many relevant opportunities as possible.

Once you’ve identified potential investors, it’s time to prepare for meetings. Here are some seed funding tips for entrepreneurs:

| Funding Option | Pros | Cons |

| Bootstrapping | Full control, no debt or equity dilution | High personal financial risk |

| Friends and Family | Trust-based, quick to secure | Potential strain on personal relationships |

| Angel Investors | Mentorship, industry connections | Giving up equity, pressure to meet investor expectations |

| Venture Capital | Large amounts of capital, professional guidance | Loss of control, high expectations for rapid growth |

| Crowdfunding | Market validation, community building | Time-consuming, no guaranteed success |

| Grants/Competitions | Non-dilutive funding, recognition | Highly competitive, lengthy application processes |

A well-prepared financial model is essential for convincing investors of your app startup’s potential for success. It provides a detailed projection of your startup’s economic performance, helping you and your investors understand the revenue potential and cost structure. Here’s how to build a comprehensive financial model for your app startup:

Revenue projections estimate how much your app will generate over a specific period. Consider the following elements:

Create a month-by-month projection for at least the first two years, showing expected growth in user numbers and revenue. Be realistic and base your assumptions on market research and industry benchmarks.

Expense forecasting involves predicting all the costs your startup will get. These typically fall into several categories:

Detail these monthly expenses and consider any seasonal variations or expected increases.

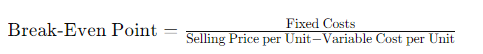

A break-even analysis helps determine when your startup will become profitable. This is the moment when your overall income is equal to your overall expenses. Calculate the break-even point using this formula:

This analysis will give investors a clear understanding of how long it will take for your startup to become self-sustaining.

Creating different financial scenarios can help you prepare for various outcomes and show investors that you have a plan for different situations. Develop at least three scenarios:

Each scenario should have its own set of revenue and expense projections, showing how your startup would fare under different conditions.

Sensitivity analysis examines how changes in key assumptions affect your financial projections. For instance, assess the impact of a 10% increase or decrease in user acquisition rates or changes in your pricing model. This helps you identify which variables significantly affect your financial outcomes and prepare strategies to manage these uncertainties.

Learning how to get seed funding for an idea involves strategic planning and execution. Start with a strong business plan with an executive summary, problem statement, solution, market analysis, revenue model, financial projections, and team. Validate your idea with an MVP and build a network for support. Explore funding options like bootstrapping, angel investors, venture capitalists, crowdfunding, and grants. Prepare thoroughly for investor meetings with a solid financial model and pitch. Address common concerns and stay persistent to increase your chances of success.

A 1: Seed funding is the initial capital used to start developing a business idea. In contrast, Series A funding is a subsequent round of funding used to scale the business after the initial product has shown some traction in the market.

A 2: The amount of equity to give up varies widely but typically ranges from 10% to 25%. Negotiating terms that align with your long-term vision and the value the investor brings is essential.

A 3: To increase your chances, have a solid business plan, build an MVP, show market validation, network extensively, and be prepared to present and defend your idea passionately and professionally.

A 4: A pitch deck should include an executive summary, problem statement, solution, market analysis, business model, traction, team, financial projections, and funding needs.

A 5: Yes, using multiple funding options simultaneously can help diversify your funding sources and reduce risk. For example, you might combine bootstrapping with crowdfunding and angel investments.

Welcome to Appxide, where innovation meets utility in the world of app development. Our mission is to craft cutting-edge digital solutions that simplify lives and spark connections. With a diverse portfolio that traverses multiple sectors, we are committed to excellence and user-centric design. Stay tuned to our blog for the latest in tech, insights, and the stories behind our projects. Dive into the future with us – where every app we create is a step towards the extraordinary.